Greetings from Enbolsa.net.

Today we will review notable movements within the different values that make up the Spanish stock market.

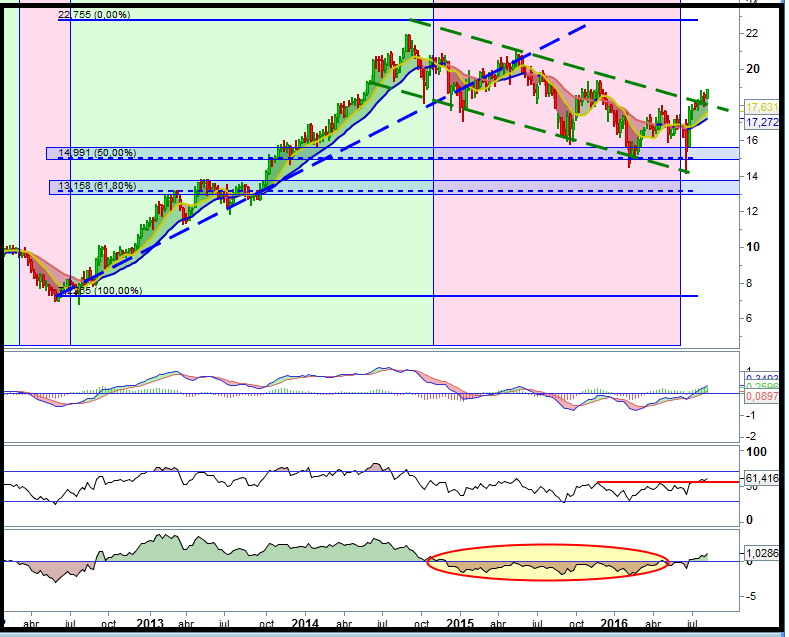

First we highlight the case of Natural Gas

In the case of natural gas and we propose a bearish strategy before finally this bearish movement finally came. However, currently there has been a radical change in the company.

observe:

An essential variation can be seen in this company, he has left the downtrend.

Once again the value reached last minimum, can be seen as the price start an upward trend which is characterized by bullish momentum uptrend and strength.

Thus we can say that is an asset to consider incorporating our investment portfolio.

But let's look at another contribution in this company:

This figure occurs in downtrends, as the forming, usually indicates a high probability of a change tenendecia. It is formed by two minimum at the same level acting as support and an intermediate point between them, denonmiando neckline, as marked inside the yellow circle. Moreover projecting the objective understood this as the distance between the minimum price and neckline, places the price target of 21 euros, considerably above than the current price.

The volume is along this training is usually down to a significant increase in volume line punctured neckline

In the case of a throwback to occur the volume will be low rise as the price approaches the target price

In conclusion, natural gas is a company that is expected to continue rising price.

Amadeus

Amadeus was also an outstanding value in the analysis in which we considered fundamental and technical situation of the company.

You can definitely see how this incorporating the uptrend again as during the last week there has been overcoming the resistance level of 40 euros.

The rise in US are a good sign for the economy, including Spanish. Given the fundamental aspects can be seen as the case of the Amadeus it is exceptional and shows financial strength, business growth and business quality, it makes improvements to market this asset is considered one reference.

On the other hand, it meets all requirements to be considered a high probability that this company situe bullish.

Also, if you want to receive all our strategic plans in real time and know when the idea of trading is available, simply subscribe for free here and can receive both via email and via whatsapp.

0 comentarios:

Publicar un comentario